The increase of new sector verticals is attracting history-breaking investments, expanding the number of start-ups in the APAC area.

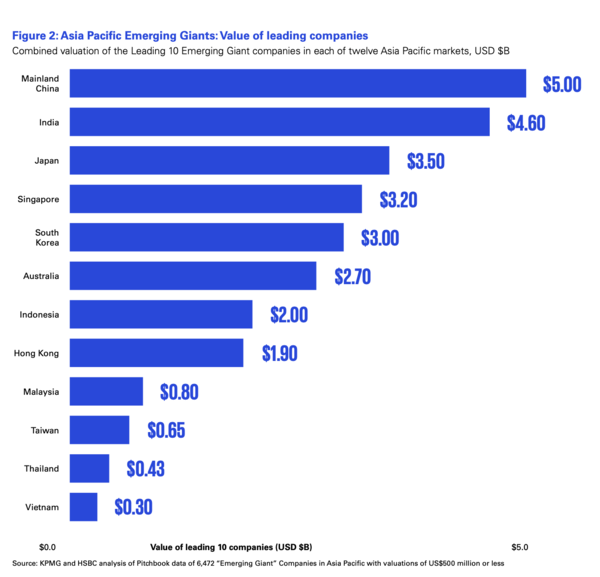

KPMG and HSBC have issued the Emerging Giants in Asia Pacific report, which notes that Asia Pacific’s maturing know-how-focused ecosystems swiftly create billion-greenback enterprises.

With the Global Financial Fund predicting that Asia Pacific’s rising markets and building economies will grow 20 for each cent more rapidly than the world-wide ordinary, Rising Giants – quick-increasing, influential, and revolutionary get started-ups with unicorn ambitions – are a main indicator of the region’s growth trajectory this 12 months.

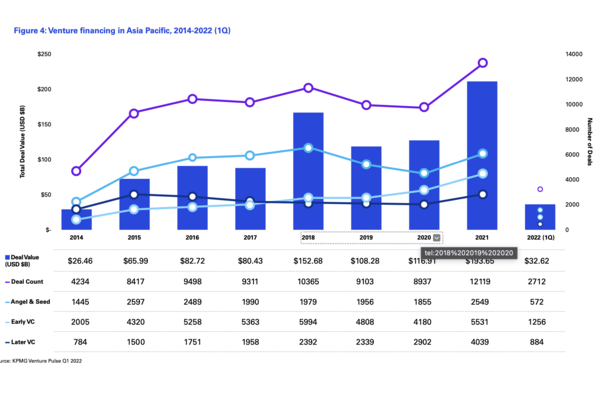

According to the analysis, while replication of the record-breaking non-public investment degrees in 2021 is inconceivable, 1Q 2022 figures suggest that 2022 will exceed the 2020 and 2019 funding levels in the Asia Pacific.

Offer values in Australia, Malaysia, and South Korea have possibly surpassed or are on their way to exceeding 2020 totals. As the world’s major fintech adopter, the Asia Pacific area has noticed a surge in economical services transformation around the very last two decades, as fintech apps have sophisticated in line with user adoption. Considerable desire in cryptocurrencies has also enhanced the variety of crypto money solutions providers and blockchain members.

“Fast-escalating know-how start out-ups are the new wave of SMEs contributing to financial expansion. The worldwide drive towards carbon-neutrality will be a key driver of innovation as standard sectors go environmentally friendly. Emerging Giants will probable engage in a crucial purpose in establishing systems that can minimize carbon emissions and endorse a lot more accountable stewardship of the surroundings. Asia will be a crucial battleground in the combat for a much more sustainable upcoming,” claims Honson To, Chairman of KPMG Asia Pacific and KPMG China.

“Emerging Giants in the Asia Pacific excites us since we see the start out-up ecosystem as complementary to the set up stop of the money services business: they are a resource of innovation and invigorate both equally area and regional economies with their dynamism,” suggests Surendra Rosha, Co-Main Government of HSBC Asia-Pacific.

“As the world’s main trade lender, we’re constantly wanting for approaches to enable our prospects innovate, build future remedies and incorporate price. As up-and-coming leaders who will shape industries in the upcoming decade, Rising Giants characterize a important constructing block for a sustainable and affluent future for the region,” states Dan Roberts, HSBC’s Global Head of Business Banking.

“Asia Pacific’s emerging giants are daring, formidable and chopping-edge in their new system and application applications. They are courageous about whom they pick to spouse with, which marketplaces they concentrate on, and how they condition their business styles and renovate organization lifestyle and mission statements. Maybe most importantly, they are reworking and revolutionary the technologies landscape over the coming decades, in addition to wondering about what is practical to their prospects now,” suggests Darren Yong, Head of Know-how, Media and Telecommunications, KPMG Asia Pacific.

Expanding strain to integrate ESG considerations into small business and investment decision procedures to meet local weather targets will practically surely trigger an explosion in desire for eco-friendly solutions and companies throughout all industries, supplying enormous opportunity for Rising Giants.

The most difficult obstructions for Rising Giants are conquering regulatory complexity and securing know-how expertise. Upcoming progress will be designed on creating productive ESG and tax approaches, using authorities incentives, and developing management techniques for scattered workforces.

The Rising Giants in Asia Pacific report can be downloaded at: https://kpmg.com/emerginggiants

https://www.organization.hsbc.com.sg/giants

Maintain up to date with our stories on LinkedIn, Twitter, Fb and Instagram.