wsmahar

There is some discussion correct now as to what stage of the current market cycle we are in. There are indicators that we are near the late innings of the common downturn in stocks and could be close to a restoration. Why’s that? Bonds could have created their low previous month all-around the June FOMC assembly. Which is when Treasury yields spiked to close to 3.5% throughout considerably of the curve. A significant bond rally ensued, having rates from the 2yr to the 10yr to under about 2.8%.

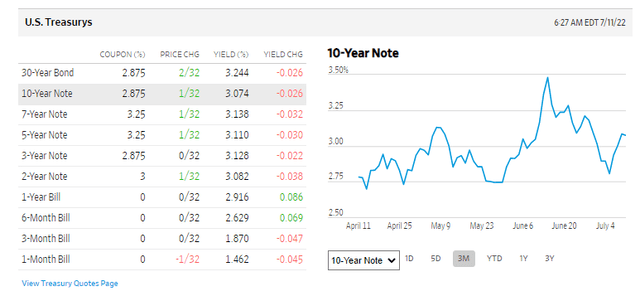

This morning, the week commences with modest bids in Treasuries with yields off just a touch in spite of some shaky weekend headlines.

U.S. Treasury Costs Today

WSJ

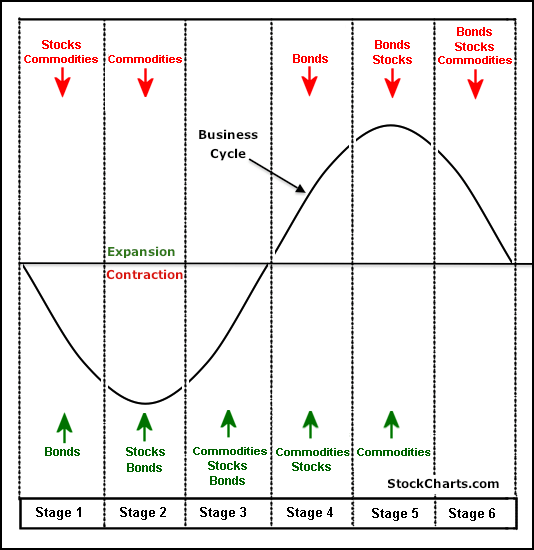

Specialists like to search at how a few teams move: stocks, bonds, and commodities. These who have long gone by means of the Chartered Current market Technician (‘CMT’) plan could remember the sequence of that trio as “BSC.” Bonds shift initially, then shares, then commodities – at least that is the rule of thumb when it comes to intermarket asset class tendencies.

For instance, a marketplace best is witnessed when shares and bonds convert lower while commodities march better (this was the scenario late very last yr). That was phase 5. Not long ago, bonds caught a bid, nevertheless, as commodities tanked. Then, as talked about earlier, bonds commenced to transfer up (yields lower) while commodities continued to pull again. That inflection normally coincides with an economic contraction (recession). So, does that necessarily mean we are close to stage 2? Should you load up on stocks? Tricky get in touch with, but let’s concentration on fastened earnings for now.

The Enterprise Cycle & Intermarket Relationships

Stockcharts.com

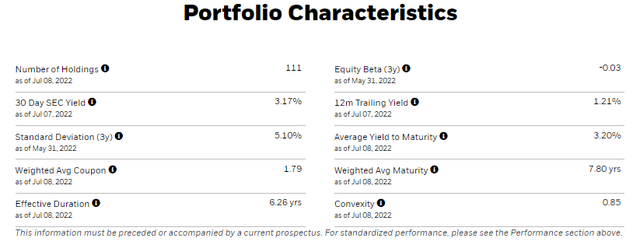

In my eye, the most effective gauge of the U.S. federal government bond current market is the iShares U.S. Treasury Bond ETF (BATS:GOVT). The fund tracks an index composed of U.S. Treasury bonds, according to iShares. Like dividends, it is down a lot more than 9% this 12 months as rates have risen major. GOVT’s length, a evaluate of sensitivity to alterations in yields, is 6.3 yrs when its recent normal produce to maturity is 3.2%. At just .05 percentage points, it is a low cost way to own default-threat-no cost Treasuries.

GOVT: The Wide Treasury Marketplace Yields > 3%

iShares

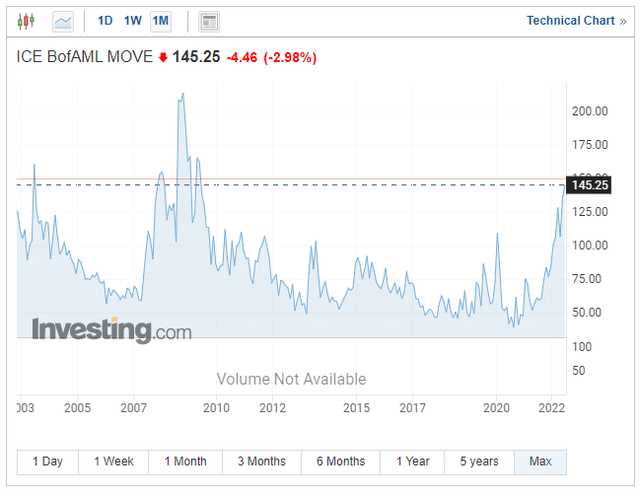

There is massive volatility throughout the Treasury produce curve proper now. The ICE BofAML Transfer Index (‘MOVE’) actions price volatility from the 2yr note to the 30yr bond making use of selection costs. At 145%, fee volatility is the greatest considering that 2009. So, count on reasonably significant swings in GOVT as opposed to usually tranquil buying and selling ranges in decades previous.

ICE BofA Shift Index: Treasury Industry Volatility Is the Optimum Considering the fact that 2009

Investing.com

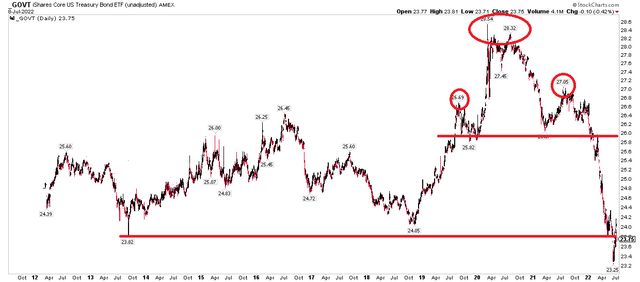

The Technological Just take

GOVT has some get the job done to do. Since the ETF’s inception in early 2012, the $24 space has been vital. It was the taper-tantrum lower in Q3 2013 and identified aid there as very well all through the price-hike cycle of late 2018. Right now, it has fallen underneath the vital place but has rallied back again to it. Could a bullish bogus breakdown be on the way? Enjoy $24 in the coming weeks. We will get crucial CPI details later on this 7 days and a pivotal Fed conference on July 27 that could spark the subsequent pattern.

Above that degree, $26 is a important line in the sand – that was a neckline to a bearish head and shoulders topping sample that spanned late 2019 via early 2022.

GOVT: $24 A Pivotal Location, Further more Resistance At $26

Stockcharts.com

The Bottom Line

GOVT tracks the total Treasury curve. Analysts are eyeing a attainable bullish reversal that could warrant a signal of a current market cycle stage shift to a much more bullish fairness regime. Time will notify but view how GOVT trades all-around the very important $24 selling price degree.