phototechno/iStock via Getty Images

Introduction

We are in the midst of a bear market and in this environment there are few safe havens. Fixed income is sharply down as well, due to rising interest rates on both the short end and the 10-year treasury which has risen to 3.48% as of this writing. Investment grade bonds are down more than 17% (see LQD) and high yield bonds are down more than 13% (see HYG). There are many bargains in this market, which we believe will rebound strongly once there is more clarity on Fed Fund rate increases and inflation. Our view on inflation is that once the 12-month rolling calculation, which is how the CPI number is reported, begins to incorporate later-2021 and early-2022 monthly numbers, we will begin to see CPI figures much lower than the 8%+ we are seeing now. There is panic selling at this time in many segments of the market, which is reflected in the large daily declines in many fixed income issues with wide bid/ask spreads. The preferred issues of CIM are an example of this phenomenon.

Company Overview

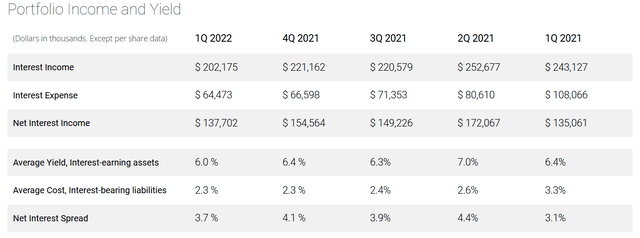

Chimera Investment Corporation is a REIT which primarily invests in residential mortgages. The company earns interest on the mortgages that it holds and earns a spread over its financing cost. The company explains its business strategy on its website. The chart below shows a summary of the interest income earned versus expenses to arrive at a net spread.

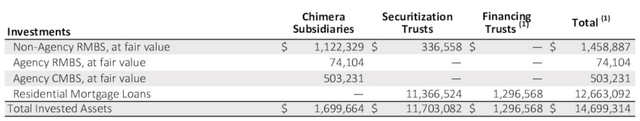

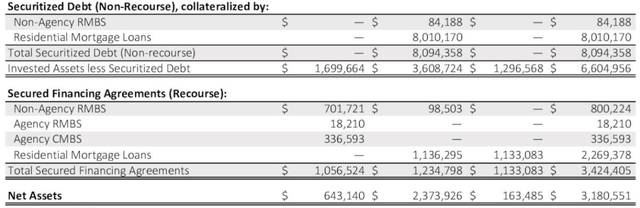

The mortgage portfolio CIM holds in various consolidated entities is summarized below. The total balance of mortgages is nearly $15 billion held mostly in securitization vehicles established by the company. 86% of the portfolio is “securitized” or sold off in specialized institutional investment vehicles (more than 30 are outstanding), which is how the company finances its purchases of mortgage assets.

The vast majority of mortgages are not “agency” backed, thus they carry credit risk without the effective government backing. In the current housing environment, with housing prices up sharply in the last 18 months, our concern regarding credit risk on the portfolio is low. The company reports holdings in 124,000 loans with a weighted average loan-to-value in the residential mortgage category of 83.7% (and lower on the agency portfolio), with average FICO scores above sub-prime, with highest concentration in CA, NY, and FL. Importantly, the loan-to-value is calculated at origination and would not include housing price gains since then.

On the financing side the company carries debt that is mainly held inside the numerous securitization vehicles (this debt is only recourse to the pool of mortgages held in each separate securitization) and another $3.4 billion that is on the balance sheet directly. The charts below summarize the liability side of the balance sheet.

Net equity is about $3.34 billion (the charts above exclude cash & receivables assets which add to the balance sheet), which includes $930 million in preferred equity. At this time with the stock price down sharply, the current market cap is about $2.6 billion. Note that invested assets less the securitized debt of $6.6 billion covers recourse debt of $3.4 billion by nearly 2x.

With interest rates on the rise a key question is the ability of the company to maintain its interest spread. The good news is that the company anticipated rate increases and in 2021 re-securitized $6 billion of loans into long-term fixed rate coupons. The company completed another securitization in 2022 with a fixed rate of 3%. CIM also moved away from “mark-to-market” type asset borrowings which greatly lowers risk in the event of major market dislocations, such as in March 2020, which could cause forced selling of assets. Overall, the company has $8.1 billion of securitized debt, or 70% of its total debt, at long-term fixed rates averaging only 2.5%. The other 30% of the company’s debt (about $3.4 billion) is repo or secured financing with various maturities ranging from 30 days to three years. The company is therefore well-positioned to weather the rise in rates, with a large portion of low-cost fixed rate debt. The company will be able to deploy new capital and principal repayments into higher yielding assets that can offset the rise in rates that will impact a much smaller portion of its balance sheet.

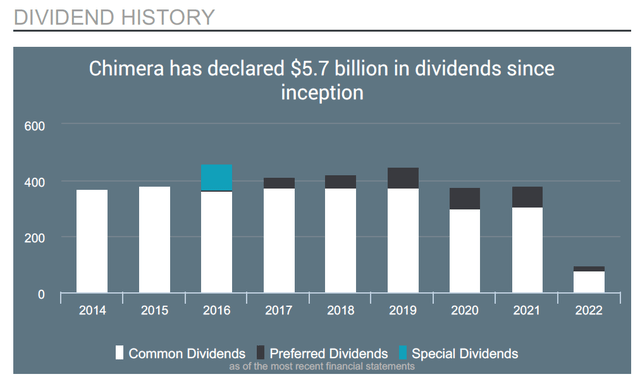

Preferred Stock Overview

As fixed income focused investors, we have generally avoided the common stock of mortgage REITs. We also find that there are many factors that can affect valuation and profitability that are volatile, often with lagging effects. With the stock price falling by about half since its recent peak in late-2021 the CIM common stock yield is >15%, which may seem tempting, but we remain uninterested in this investment (although a good argument can be made for a strong rebound in the stock price). We find a better risk/reward in the preferred issues. Preferred stockholders are of course entitled to full payment of dividends prior to any common stock dividends, and in this case they are cumulative. CIM has a strong track record of paying a common dividend through various market cycles, and thus by definition its full preferred dividend, as seen in the chart below which is through Q1 2022. Notably, the company did not suspend its dividend, but did reduce it, in the market lows of Spring 2020 when there was tremendous liquidity pressure, perhaps the biggest threat to mortgage REITs in history, that caused some of its peers to suspend dividends.

CIM Dividend History (Company Presentation)

The company has four issues of preferred stock outstanding. Note that as a REIT, preferred dividends paid are not qualified:

CIM Series A (CIM-A) (NYSE:CIM.PA): 8.00% fixed rate, callable as of 10/30/21, currently trading around $21.08 for a current yield of 9.5%.

CIM Series B (CIM-B) (NYSE:CIM.PB): 8.0% fixed/floating, callable 3/30/24. The rate is fixed at 8.00% until 3/30/24 and then floats at LIBOR+5.79%. Currently trading around $21.16 for current yield of 9.5%. At the floating rate, based on today’s LIBOR, the dividend rate would be about 7.5% and the current yield about 8.9%.

CIM Series C (CIM-C) (NYSE:CIM.PC): 7.75% fixed/floating, callable 9/30/25. The rate is fixed at 8.00% until 9/30/25 and then floats at LIBOR+4.74%. Currently trading around $19.52 for current yield of 9.9%. At the floating rate, based on today’s LIBOR, the dividend rate would be about 6.4% and the current yield about 8.2%.

CIM Series D (CIM-D) (NYSE:CIM.PD): 8.00% fixed/floating, callable 3/30/24. The rate is fixed at 8.00% until 3/30/24 and then floats at LIBOR+5.38%. Currently trading around $20.29 for current yield of 9.9%. At the floating rate, based on today’s LIBOR, the dividend rate would be about 7.1% and the current yield about 8.7%.

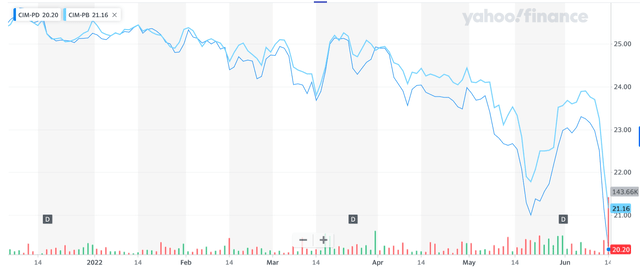

In all cases the preferred yield is elevated with current yields close to 10%, reflecting the sharp declines in the market prices for these issues. On the day of this writing on June 14, 2022, each of these issues declined more than 4% in what we would call indiscriminate panic selling. Each of these issues has its own merits; at this time we prefer to have the floating rate features, although it is certainly arguable that the fixed rate of Series A is better long term. In the event that short-term rates remain elevated for many years, these floating rate issues will benefit. The Series B and D look most attractive to us, as the lower floating rate of the Series C makes it far less interesting. While one can argue which one is better, at this time our choice would be the Series D which has fallen about 20% in price this year. As seen in the chart below, both the B and D were trading tightly together in the $25.20 range in early 2022, but the D has fallen nearly $1.00 below the B in the last few days, a significant widening.

CIM B vs C price (Yahoo Finance)

An investment in the Series D today nets an investor about a 10% current yield, as well as significant potential price recovery, and provides protection against rising short-term rates that could last for many years. In either case it appears in our opinion that the selling of CIM preferred issues is overdone and the yields offered today are highly attractive even in a rising rate environment. The 13% price decline in the last three trading days is indicative of panic selling and not reflective of a fundamental long-term change in the true risk/reward of CIM preferred stock.

Conclusion

The key risks to CIM are primarily held by common shareholders. Changes in interest rates may continue to make book value volatile, and there is always a possibility of a dividend cut, although for Q1 2022 earnings available for distribution of $0.39 per share covered the dividend of $0.33, so there is no reason to believe a dividend cut is on the way. The current environment for home prices (even if they cool off) and mortgage servicing by homeowners is strong, so credit concerns on the portfolio are low in our view, even in the event of a recession. The company appears to be much better positioned in 2022 than it was in 2020, with a debt profile comprised of 70% fixed rate debt at 2.5% put on the books in 2021, which looks very good today with the 10-year at 3.5%. The reduction in mark-to-market assets also lowers risks of liquidity shocks which were seen in March 2020.

Preferred shareholders enjoy much lower risk than common in payment of their dividend. In Q1 2021 total preferred dividends were $18.4 million versus $78.2 million for the common. Thus out of a pool of $96.6 million earmarked for dividends, preferred shareholders were entitled to the first $18.4 million; as already discussed, the company has never suspended its common dividend, let alone its preferred. We continue to add to positions in CIM preferred stock in our portfolios.

Please be aware that Downtown Investment Advisory currently holds CIM preferred issues in client and personal accounts, and may have added/will add to positions at any time prior to or following the publication of this article.

It is important to note that fixed income investments such as high yield bonds, BB and lower preferred stock such as CIM preferred issues, closed end funds, and baby bonds are by definition not “investment grade” and are thus only appropriate for investors willing to accept a higher fixed income risk profile. High yield fixed income investments may not be appropriate for all portfolios, so consider these investments only as part of a broader investment portfolio allocation to various assets of all risk profiles.

Please see the Downtown Investment Advisory profile page for important disclaimer language, which is an integral part of this article.