dima_sidelnikov/iStock by way of Getty Images

Most traders in their operating and retirement several years have most likely listened to about the 4% rule, in which a retiree should goal drawing 4% from their investment decision harmony each and every yr. The concern remains, even so, on what sorts of investments a person need to goal in the first place.

For just one matter, the S&P 500 (SPY) continue to yields just 1.6%, rarely sufficient to satisfy the 4% rule with out just one possessing to touch their principal, and we all know that promoting the principal can be detrimental to a portfolio when the market is obtaining a down calendar year, as we obtain ourselves in so much.

This provides me to Fidus Expenditure (NASDAQ:FDUS), which is a properly-run BDC that throws off a superior produce that one can use to fund living costs. This post highlights what makes the new offer-off a excellent possibility to layer into this identify, so let’s get began.

Why FDUS?

Fidus Financial investment is an externally-managed BDC that invests generally in lessen center-sector, as defined by U.S. providers with annual revenues concerning $10M and $150M. It was established in 2007 as a Tiny Enterprise Financial investment Organization and went IPO as a BDC in 2011.

Fidus targets corporations in market marketplaces with defensible current market positionings, diversified consumer and supplier bases, and strong free of charge hard cash flows with significant fairness cushions. Like a number of of its greater friends such as Primary Street Capital (Main), FDUS invests mostly in the reduced middle industry place, which is hugely fragmented with far more than 100,000 corporations and features interesting danger-adjusted returns.

At existing, it has a diversified portfolio totaling $812 million distribute across 74 providers. 84% of Fidus’s investments are in the type of secured debt (59% initial lien, 25% second lien), with the remainder comprised of increased yielding subordinated financial debt (7%) and fairness (8.8%) for a growth kicker.

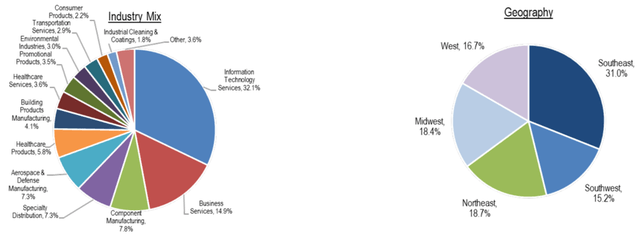

As revealed down below, the portfolio is largely defensive in character, with IT, Company Companies, Component Producing, and Specialty distribution comprising 62% of the portfolio.

FDUS Portfolio Combine (Trader Presentation)

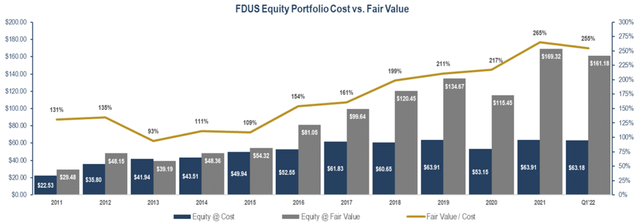

Fidus maintains equity investments in 82% of its portfolio corporations. This strategy has worked out nicely for Fidus, as fairness signifies 19.8% of the portfolio truthful benefit, evaluating favorably to the aforementioned 8.8% portfolio price. Considering that IPO, FDUS has an remarkable keep track of report of $183 million in understood internet cumulative capital gains. As shown down below, FDUS experienced equity gains each and every yr because 2011 apart from for 2013.

FDUS Fairness Gains (Investor Presentation)

FDUS has ongoing to display robust fundamental fundamentals, with NAV per share rising by $.48 YoY to $19.91 in the initial quarter. While NII for each share was down by $.03 YoY $.42, it amply handles the standard dividend of $.36 for every quarter with a 1.17x dividend coverage ratio. Investments on non-accrual continue to be very low, at just .3% of portfolio reasonable worth.

Searching ahead to Q2 results and beyond, would expect for NII for every share to strengthen as Fidus maintains a very sturdy balance sheet, with a regulatory debt to equity ratio of just .6x, sitting down very well underneath the 2.0x statutory limit.

Threats to FDUS contain opportunity conflicts of curiosity owing to exterior administration, and a slowdown in economic action. Administration, even so, observed file ranges of non-public funds sitting down on the sidelines as currently being a prospective backstop, as pointed out throughout the latest convention simply call:

So the current market now appears to be mainly concentrated on organizations that that have not been meaningfully impacted by COVID-19 or the supply chain issues and overall inflation dynamics that certainly numerous corporations are experiencing and experiencing.

And, in simple fact, what we’re, we are continuing to see a premium paid out for people companies that are running devoid of meaningful incident or worry of individuals issues. You can find obviously a reasonable little bit of pent up need and a whole lot of liquidity made to devote in superior top quality property.

In truth, I would say non-public equity and private credit card debt, war chest for deficiency of a much better term, are close to record amounts right now. So, as I would, as I sit right here these days, I would propose activity concentrations are continue to moderately reliable in the reduce middle industry, but definitely, nowhere near final calendar year.

And lastly, I obtain the existing share value of $17.83 to be beautiful, specially soon after its fall from the $20-stage as just lately as early June. This equates to a cost to e-book value of just .9x, sitting at the lower end of its trading assortment over the past year.

FDUS Rate to E book (Seeking Alpha)

Sell side analysts have a consensus Get ranking with an ordinary selling price concentrate on of $20.90. This implies a probable one particular-calendar year 25% complete return which include common dividends. This could be increased contemplating that FDUS paid out $.24 for every share truly worth of distinctive dividends in the very first 50 % of this 12 months alone.

Trader Takeaway

Fidus Investment decision Company is a BDC that presents eye-catching risk-adjusted returns. It has a diversified portfolio across defensive industries in the fragmented reduced middle industry room, and carries on its potent monitor file of producing healthful gains on its equity investments. I locate the shares and the very well-protected dividend to be eye-catching, specially soon after the recent fall in share cost.