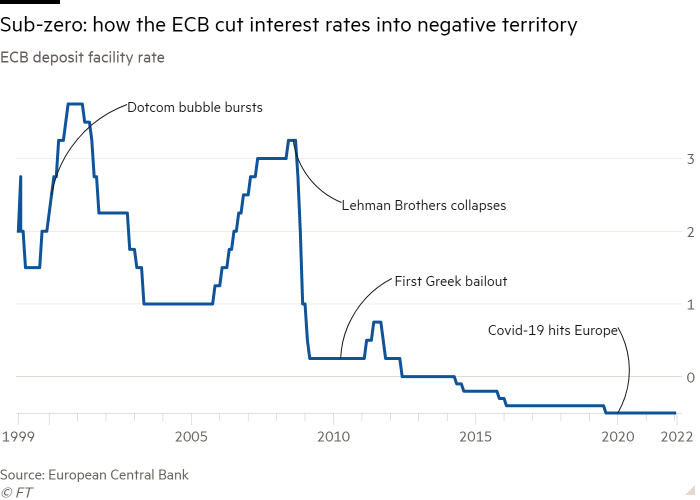

When Christine Lagarde on Thursday sets out the European Central Bank’s programs to close eight many years of bond-purchasing and detrimental curiosity costs, she can count on the assist of the extensive vast majority of her fellow price-setters.

Record-substantial inflation in the eurozone has still left even the most dovish of the 25 customers of the governing council supporting the want for increased borrowing fees in the coming months.

Nevertheless, the president will be knowledgeable of the scale of the challenge struggling with the ECB, hoping to regain regulate of price ranges without having tipping the financial system into recession or triggering a bond market place worry in the more vulnerable nations of southern Europe.

“Lagarde is in the hot seat and she is feeling it,” claimed Klaus Adam, an economics professor at the University of Mannheim who advises Germany’s finance ministry. “The ECB seems to feel it can bring inflation again to goal with fairly timid raises in prices. But what if that doesn’t function?”

The final time the lender lifted fees in 2011, none of its 25 governing council members experienced joined the amount-setting overall body and Lagarde had just grow to be president of the IMF.

Issues abound between economists that the council lacks the economics abilities to get the harmony right among fighting inflation and steering clear of an financial and economic meltdown.

Lagarde, a law firm by coaching and France’s finance minister before earning the switch to Washington, has relied on ECB chief economist Philip Lane for guidance. But he has been criticised for staying also gradual to predict the new surge in inflation, which shot over 8 for every cent in Could, quadruple the ECB’s goal.

Other western central financial institutions, these as the US Federal Reserve and Lender of England, have already lifted rates and stopped purchasing bonds. “Who can she count on now?” said Adam. “She is no qualified herself and her chief economist has been so mistaken on inflation.”

Though the council users, assembly in Amsterdam for a transform from Frankfurt this 7 days, are in unison on the have to have for price raises — and to dedicate to a backstop for bond marketplaces — there is fewer consensus on the tempo of tightening.

Lagarde and Lane have signalled level rises of a quarter of a percentage place as the benchmark for its meetings in July and September — the two that observe the June choice.

But the tempo at which price pressures have intensified around recent months has remaining hawks contacting for a far more intense speed of tightening, in line with the Fed’s tactic of mountaineering by 50 foundation factors at a time.

“The hawks smell blood,” reported a a lot more dovish council member.

Most economists still assume the ECB is likely to stick to a quarter-point amount increase in July, partly mainly because of the be concerned that a more aggressive go could cause a offer-off in the bond markets of seriously indebted nations, this sort of as Italy.

Paul Hollingsworth, chief European economist at BNP Paribas, explained a 50-foundation stage fee rise “would be a hawkish surprise and could increase dangers for peripheral bond marketplaces previously than the ECB would like”.

The distribute among Italy’s 10-calendar year borrowing charges and people of Germany, a vital evaluate of perceived monetary threat in the euro area, has lately risen to its optimum amount because the get started of the pandemic.

“Some traders are fretting about the place spreads could go as soon as the ECB starts to remove its stimulus,” said Annalisa Piazza, fastened-revenue analyst at MFS Financial commitment Administration.

The ECB has presently said it expects to raise the charge at which it lends to lots of banking companies by 50 percent a percentage place this thirty day period. It will finish the special lower price fee of minus 1 for each cent on a few-year financial loans produced underneath its quarterly targeted longer term refinancing operations, or TLTROs. This level will return to the deposit charge of minus .5 for every cent.

Oliver Rakau, an economist at Oxford Economics, stated the TLTRO modify could make the ECB reluctant to compound the impact by also increasing its deposit fee by fifty percent a proportion level in July. “We are previously observing a tightening of bank lending circumstances in the eurozone and [the ECB] would danger a steeper tightening than they can abdomen, specifically in weaker international locations,” he reported.

At this week’s conference, the ECB will also difficulty new forecasts. They are anticipated to outline slower growth and larger inflation more than the subsequent a few decades. Its 2024 forecast for inflation is very likely to rise to its 2 per cent target — fulfilling a key requirements to increase fees.

For now enterprise surveys, as effectively as info on exports, industrial manufacturing and retail gross sales, show the eurozone is heading for a slowdown rather than a economic downturn this 12 months.

Having said that, the bloc is getting hit notably really hard by the fallout from Russia’s invasion of Ukraine, which has despatched European energy and food costs soaring, crimping the expending ability of shoppers whose wages have risen a lot more slowly.

Goldman Sachs economist Sven Jari Stehn warned that if the war deepens and Russian gas supplies to Europe are cut off, it could plunge the region into a “short, but sharp, recession”.

This stagflation scenario of a shrinking economic climate with persistently superior inflation is just one that anxieties quite a few price-setters. “It is not going to be uncomplicated for the ECB,” explained Hollingsworth. “There are a selection of hurdles for them to get over.”