Following a dismal calendar year for Chinese tech corporations, the $9bn that Sequoia China lifted before this thirty day period to fund hundreds additional start out-ups was a show of star electric power from the venture capital group’s billionaire founder Neil Shen.

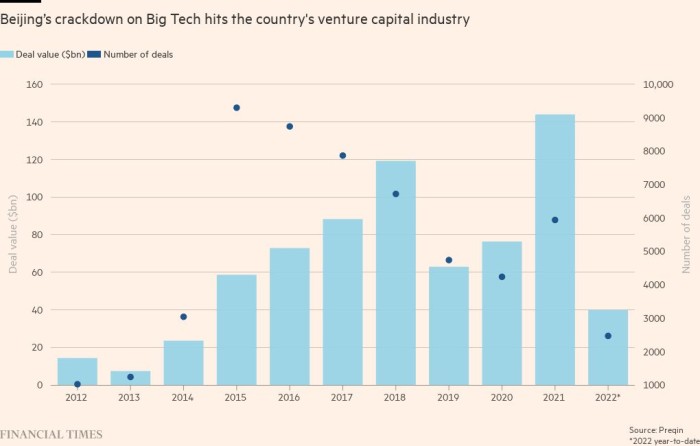

Shen’s friends have struggled to increase dollars this yr, subsequent heightened political danger and Beijing’s crackdown on Massive Tech, which has pressured some world-wide establishments to place their China investments on maintain.

By contrast, Shen has raised cash by managing to trip China’s political currents and align with President Xi Jinping’s “common prosperity” coverage aims, according to past associates, rival investors and many others shut to the country’s tech and investment scene.

“Everybody is getting to acquire inventory and reassess what it signifies to commit in China,” claimed David Brown, head of Asia deals at consulting agency PwC, speaking about the Chinese investing setting. He additional only the “crème de la crème” of money with robust community information would endure.

Considering that launching Sequoia China in 2005 as an arm of Silicon Valley investment decision big Sequoia Funds, Shen has built a private fortune really worth $4bn subsequent early investments in TikTok dad or mum ByteDance and ecommerce giants Alibaba and Meituan.

As the federal government has brought to a halt a golden age for China’s net firms — the sweet spot on which Shen has designed a agency with assets under management of all around $50bn — it is uncertain how, or if, buyers in China can continue on to uncover prospects that will produce the major returns they have been made use of to.

4 months in the past, Shen hinted at a new approach all through a speech to the country’s prime political consultative body. He explained to the audience that China ought to prioritise escalating industries like synthetic intelligence, autonomous cars and robotics, as well as inexperienced strength and pharmaceutical investigate.

The speech demonstrated an “eagerness to realign his expenditure themes with anticipated coverage trajectories”, said a chief government of a rival enterprise money organization.

“Politically correct” sectors have emerged in China’s new financial state, in accordance to undertaking funds traders. These consist of “deep tech” this sort of as AI and robotics, and “hard tech” like electrical auto batteries and semiconductors. These are sectors in which Beijing has outlined programs to lower its reliance on international technological know-how.

“Invisibly there are crimson strains that you can’t contact and the trick is navigating what individuals are,” explained Henry Zhang, president of Hong Kong-primarily based Hermitage Funds. “If you commit in one thing the govt encourages you will have a ton of tailwinds. The governing administration is pouring income into people sectors so you have both of those policy and monetary guidance.”

Shen has very long nurtured near political relationships. He is the sole delegate representing the venture money sector in the Chinese Peoples’ Political Consultative Meeting, a vital political advisory overall body.

He has also prevented significantly of the new scrutiny on tech tycoons these types of as Alibaba’s Jack Ma, in spite of his fund’s connections to California-primarily based Sequoia Money.

Even though run as an independently managed enterprise, Sequoia China passes some of its carried curiosity back up to the world team, in accordance to a human being familiar with the structure. The China arm has a sprawling portfolio of extra than 900 organizations, far more than 100 of them valued at about $1bn.

“When we glimpse back again in heritage it would seem apparent to us that Shen captured this opportunity, but at that time there was no clear respond to in China, what sectors to aim on, which founders to back,” claimed a person of the buyers in his funds.

But Sequoia China has also been highly exposed to the crackdown that wiped more than $2tn off Chinese shares in the US and paralysed the sector for Chinese companies listing overseas.

As perfectly as staying a shareholder in big outlined businesses like ride-hailing application Didi and vaping team Relx, whose share price tag has crashed 84 for every cent because listing, it was also one of the greatest venture backers of on the net instruction businesses, which have been an additional key casualty of the regulatory overhaul.

“It was a huge correction,” according to the investor. The returns of one particular of its funds have been slash by as a great deal as half next the regulatory action, the individual claimed. A next human being stated that total performance was secure throughout Sequoia China’s money.

Shen’s political impact has not shielded him from geopolitical turbulence in the past. The investor brought each LinkedIn and Airbnb to China around six yrs ago in what was then a progressive experiment in US platforms navigating China’s censorship guidelines. Equally have since exited the place.

DJI, a dronemaker that Shen backed prior to any outside trader, has been blacklisted in the US over stability considerations. Shen has courted controversy with cryptocurrencies, which ended up successfully banned in China in 2021. Shen entered a offer to back again the world’s premier crypto trade Binance in 2017. Immediately after the ban, a screenshot of Shen appearing to say in an on-line information he was “all in” on crypto went viral in the place.

“Sequoia China has been very good at riding a bull sector in tech for most of the very last 20 a long time but you won’t get these multibillion-greenback buyer online promotions any more,” reported the chief govt of a rival Chinese enterprise capital company.

Still, Shen has shown he can influence overseas investors to pour new funds into Sequoia China, even while facing a vastly various investing setting in the coming several years.

“The rapid ‘unicorn-making, IPO, profit’ enterprise model is absent,” claimed the investor in Sequoia China cash. “The upcoming stage will be much more common undertaking capital: disruptive know-how and business styles, more compact discounts and lengthier time horizons.”