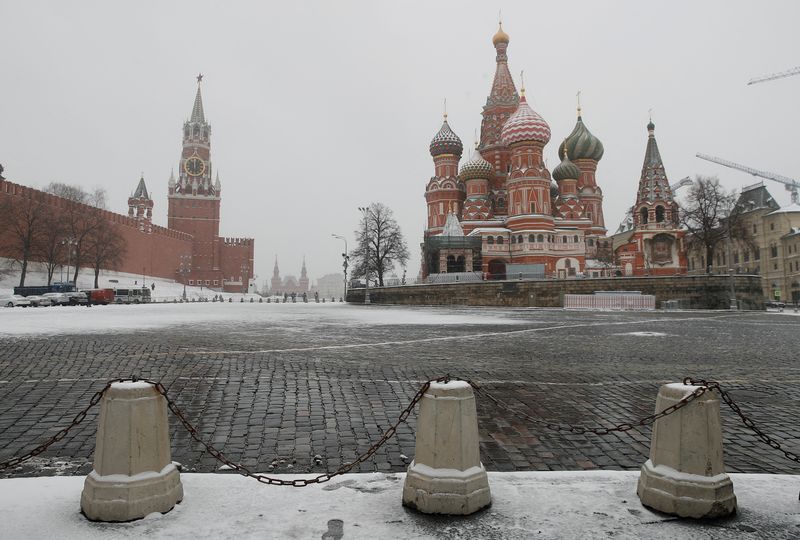

© Reuters. FILE Photo: The clock on Spasskaya tower displaying the time at noon, is pictured up coming to Moscow?s Kremlin, and St. Basil?s Cathedral, March 31, 2020. REUTERS/Maxim Shemetov

By Karin Strohecker

LONDON (Reuters) -Russia appeared established for its to start with sovereign default in decades as some bondholders claimed they experienced not been given overdue curiosity on Monday following the expiry of a important payment deadline a working day previously.

Russia has struggled to continue to keep up payments on $40 billion of remarkable bonds since its invasion of Ukraine on Feb. 24, as sweeping sanctions have properly slash the nation off from the world wide economical procedure and rendered its property untouchable to quite a few buyers.

The Kremlin has frequently mentioned there are no grounds for Russia to default but it is not able to send money to bondholders mainly because of sanctions, accusing the West of trying to drive it into an artificial default.

Russia’s attempts to avoid what would be its initially important default on intercontinental bonds considering the fact that the Bolshevik revolution a lot more than a century back hit a insurmountable roadblock in late May well when the U.S. Treasury Department’s Office of International Assets Management (OFAC) efficiently blocked Moscow from generating payments.

“Considering that March we imagined that a Russian default is in all probability unavoidable, and the problem was just when,” Dennis Hranitzky, head of sovereign litigation at regulation organization Quinn Emanuel, informed Reuters. “OFAC has intervened to reply that concern for us, and the default is now upon us.”

Even though a official default would be largely symbolic presented Russia can not borrow internationally at the instant and does not require to thanks to abundant oil and gasoline export revenues, the stigma would possibly elevate its borrowing expenditures in upcoming.

The payments in concern are $100 million in fascination on two bonds, one particular denominated in U.S. dollars and a different in euros, Russia was because of to shell out on May well 27. The payments experienced a grace period of time of 30 days, which expired on Sunday.

Russia’s finance ministry explained it produced the payments to its onshore Nationwide Settlement Depository (NSD) in euros and pounds, including it has fulfilled obligations.

Some Taiwanese holders of the bonds experienced not obtained payments on Monday, sources instructed Reuters.

For several bondholders, not getting the cash owed in time into their accounts constitutes a default.

With no correct deadline specified in the prospectus, lawyers say Russia might have till the stop of the subsequent company day to spend the bondholders.

Little PRINT

The authorized situation surrounding the bonds appears to be like complicated.

Russia’s bonds have been issued with an unusual selection of terms, and an raising degree of ambiguities for these offered more recently, when Moscow was now experiencing sanctions more than its annexation of Crimea in 2014 and a poisoning incident in Britain in 2018.

Rodrigo Olivares-Caminal, chair in banking and finance legislation at Queen Mary University in London, mentioned clarity was necessary on what constituted a discharge for Russia on its obligation, or the big difference involving getting and recovering payments.

“All these concerns are issue to interpretation by a court docket of legislation, but Russia has not waived any of its sovereign immunity and has not submitted to the jurisdiction of any court in any of the two prospectuses,” Olivares-Caminal instructed Reuters.

In some methods, Russia is in default now.

A committee on derivatives has ruled a “credit history party” had occurred on some of its securities, which activated a payout on some of Russia’s credit rating default swaps – instruments utilised by traders to insure exposure to financial debt towards default. This was activated by Russia failing to make a $1.9 million payment in accrued curiosity on a payment that had been owing in early April.

Right up until the Ukraine invasion, a sovereign default had seemed unthinkable, with Russia getting rated expenditure quality up to shortly before that point. A default would also be unusual as Moscow has the funds to services its personal debt.

The OFAC experienced issued a non permanent waiver, identified as a basic licence 9A, in early March to allow Moscow to keep paying out investors. It let it expire on Might 25 as Washington tightened sanctions on Russia, efficiently chopping off payments to U.S. traders and entities.

The lapsed OFAC licence is not the only impediment Russia faces as in early June the European Union imposed sanctions on the NSD, Russia’s appointed agent for its Eurobonds.

Moscow has scrambled in modern times to obtain methods of dealing with impending payments and keep away from a default.

President Vladimir Putin signed a decree final Wednesday to launch short-term processes and give the government 10 times to select banking companies to cope with payments less than a new scheme, suggesting Russia will take into consideration its debt obligations fulfilled when it pays bondholders in roubles.

“Russia stating it is complying with obligations underneath the terms of the bond is not the complete tale,” Zia Ullah, husband or wife and head of company crime and investigations at regulation agency Eversheds Sutherland advised Reuters.

“If you as an investor are not contented, for occasion, if you know the cash is trapped in an escrow account, which successfully would be the simple impact of what Russia is expressing, the answer would be, until eventually you discharge the obligation, you have not contented the circumstances of the bond.”